Magazine

Maple Sugaring | Boom or Bust

Maple sugaring has been part of the New England farming landscape for generations. Today, however, technology and big money may alter that forever.

Tapping a tree in the Branon sugarbush, near an abandoned sugarhouse.

Photo Credit : Corey Hendrickson Tommy Branon and I rode out of Cold Hollow in the cab of a truck carrying more than 4,000 gallons of Vermont maple sap. The gravel road was soft; it had been a hard winter and a late spring, and the cold had driven frost deep into the ground. Now the frozen soil was slowly thawing, creating potholes filled with muddy water. The road’s shoulders looked fragile, as if yearning to slough into the ditch.

Tommy shifted down as the grade steepened. An instant-read thermometer jiggled in his shirt pocket as the truck chugged under the load. He glanced at the side-view mirror, hoping to catch sight of his son, Evan, who sat behind the wheel of an even bigger truck, hauling an even bigger load of sap. With the weight of the sap and the truck combined, Evan had to be pushing 70,000 pounds, and Tommy didn’t want to spend the afternoon extricating 70,000 pounds of metal and maple water from a ditch. He’d done that before. He had a rope in the truck expressly for that purpose. It was as big around as my wrist. Bigger, maybe.

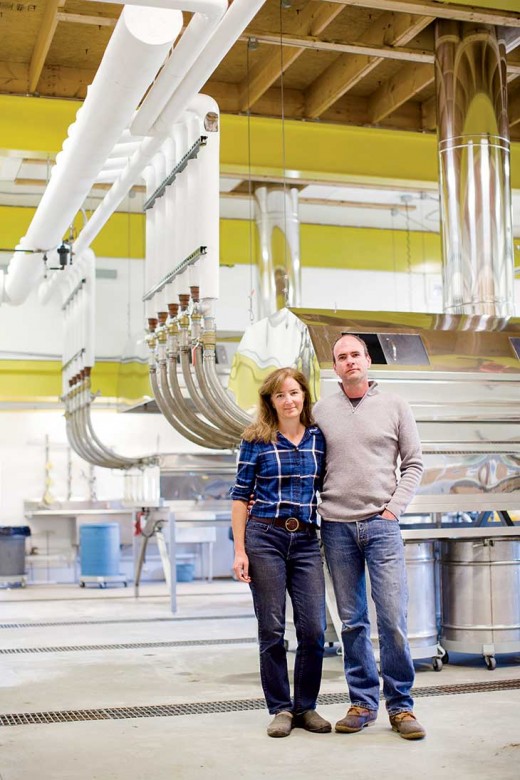

Finally, we made the height of land just outside the small town of Bakersfield, Vermont. Evan was still behind us, and I could see Tommy relax a bit, though he still leaned forward in his seat. My impression was that he had spent most of his life leaning forward. From here, it was pretty much downhill to the paved road, and then an easy six or seven miles over blacktop before hanging a left onto the final stretch of dirt leading to the sugarhouse where Evan’s brother, Kyle, was making syrup at a furious pace. I’d met Kyle earlier in the day, standing next to an evaporator that looked to me like something out of a deep-sea science-fiction movie, all gleaming steel and hard angles and pipes and valves. Kyle looked tired; he had circles under his eyes, and the way the sap was running, they weren’t likely to go away anytime soon.

Tommy Branon and I rode out of Cold Hollow in the cab of a truck carrying more than 4,000 gallons of Vermont maple sap. The gravel road was soft; it had been a hard winter and a late spring, and the cold had driven frost deep into the ground. Now the frozen soil was slowly thawing, creating potholes filled with muddy water. The road’s shoulders looked fragile, as if yearning to slough into the ditch.

Tommy shifted down as the grade steepened. An instant-read thermometer jiggled in his shirt pocket as the truck chugged under the load. He glanced at the side-view mirror, hoping to catch sight of his son, Evan, who sat behind the wheel of an even bigger truck, hauling an even bigger load of sap. With the weight of the sap and the truck combined, Evan had to be pushing 70,000 pounds, and Tommy didn’t want to spend the afternoon extricating 70,000 pounds of metal and maple water from a ditch. He’d done that before. He had a rope in the truck expressly for that purpose. It was as big around as my wrist. Bigger, maybe.

Finally, we made the height of land just outside the small town of Bakersfield, Vermont. Evan was still behind us, and I could see Tommy relax a bit, though he still leaned forward in his seat. My impression was that he had spent most of his life leaning forward. From here, it was pretty much downhill to the paved road, and then an easy six or seven miles over blacktop before hanging a left onto the final stretch of dirt leading to the sugarhouse where Evan’s brother, Kyle, was making syrup at a furious pace. I’d met Kyle earlier in the day, standing next to an evaporator that looked to me like something out of a deep-sea science-fiction movie, all gleaming steel and hard angles and pipes and valves. Kyle looked tired; he had circles under his eyes, and the way the sap was running, they weren’t likely to go away anytime soon.

Photo Credit : Corey Hendrickson

Photo Credit : Corey Hendrickson

Photo Credit : Corey Hendrickson

—

Not very long ago, the notion that a family could earn a full-time, year-round living making and selling maple syrup would have been dismissed as pure folly. Historically speaking, sugarmaking in Vermont and the rest of New England has been a sideline business, often a way for dairy farmers to supplement their income. Indeed, that’s precisely how the Branons’ maple operation began: a team of horses, a few thousand taps, and a handful of sleepless nights every spring. But over the past decade, and particularly in the past handful of years, the possibility of sugarmaking-as-career has taken root. This possibility is fueled by numerous factors, including evolving technologies that allow sugarmakers to prevail over sub-optimal weather conditions, expanding markets hungry for every drop of recent bumper crops, profit-making wholesale prices, and a tumultuous economy that has entrepreneurs eyeing maple trees with new intent. The result? Over the decade spanning 2003 to 2013, the number of taps statewide has doubled, from 2,120,000 to 4,200,000, as established sugarmakers have expanded operations and new sugarmakers have entered the market, eager to cash in. Of course, Vermont isn’t the only place maple syrup is made, but it’s fair to say that the connection between Vermont and maple syrup is as established as the link between Idaho and potatoes or Florida and oranges. The Green Mountain State generally accounts for about 40 percent of U.S. production and 5 to 8 percent of the global supply; in a good year, Vermont producers make more than $40 million worth of syrup. That’s still a fraction of the $560 million annual income attributed to the state’s dairy industry, but it’s nothing to sneeze at. Taken at face value, Vermont’s rapidly expanding maple industry is nothing but good news, providing much-needed income in the aftermath of the Great Recession and supporting dairy farmers for whom the additional revenue is essential to maintaining farm operations. But dig a little deeper, and one begins to uncover the seeds of uncertainty. Uncertainty that such rapid expansion can continue. Uncertainty that it can even be sustained. Uncertainty, even, that some of the emerging technologies are good for the industry. “Most people who think about it are a little spooked,” Matt Gordon told me. Gordon is the executive director of the Vermont Maple Sugar Makers Association. “It’s such a big change.” David Marvin, the man at the helm of Butternut Mountain Farm in Morrisville, one of the largest distributors of maple syrup in the world, and a sugarmaker in his own right, concurred. “We’re in a bubble,” he said forthrightly. “It’s not going to go ‘kapow’ and blow up the industry, but we’re in a bubble.” Marvin knows a maple bubble when he sees one; he’s been in the industry for more than four decades and has lived through three boom-and-bust cycles. “They’re generally the result of overproduction, leading to a drop in prices,” he explained, recalling a period in the early 1980s when historically high prices were sent into a downward spiral by the bumper crop of ’81. The annual maple harvest remained strong for a few more years, before settling into a range more aligned with historical norms, as sugarmakers scaled back in the face of depressed prices. All of which is enough to make you wonder: If previous booms have resulted in subsequent busts, what’s to keep the same thing from happening again?—

If you imagine sugarmaking the way most New Englanders imagine sugarmaking—buckets hanging serenely from trees, draft horses standing patiently as the gathering tank is filled one sloshing bucket at a time, while in the distance woodsmoke steam rises from the sugarhouse chimney—well, you might want to stop reading now. As I learned on my visit with the Branons, the reality of modern sugarmaking on a commercial scale includes none of those images. The morning of my ride with Tommy, I spent three hours with Cecile, bouncing through the woods in a high-tech off-road buggy worth at least 300 gallons of syrup at full retail price ($15,000, give or take). We buzzed a half-mile or so down the road before stopping at a booster station, a union of pipeline and valves that to my eyes looked impossibly complicated, but that to Cecile looked like a place where answers are found. One by one, she began cracking valves open, until we heard a whoosh of air. “Hear that?” she asked, triumphant. “That’s a problem.” We clambered back into the buggy, turned up a muddy trail, and began churning our way into the sugarbush.

Photo Credit : Corey Hendrickson

—

Not long after my visit with Cecile and Tommy, I traveled to the Proctor Maple Research Center to see firsthand a change that could dwarf all those I’d witnessed at the Branons’. The Proctor center is a research, demonstration, and educational facility run by the University of Vermont in Underhill, about 25 miles due south of the Branon operation. Proctor is one of the few places in the world where one can discuss things like the microbiology of maple sap, the chemistry of syrup, and the abiotic stresses affecting sugar-maple trees and find plenty of willing ears. But I hadn’t come to talk about any of those things. Instead, I’d come to see a technology that some people claim will revolutionize the industry faster and more profoundly than any that has come before. Known as the “plantation technique,” the practice involves removing the top (known as “pollarding”) of a young maple sapling, sealing the cut-off end in plastic, and installing a spout under high vacuum inside the plastic. It works because sap is actually produced in a tree’s roots, not in the crown, as many people assume. And it works because the young saplings can be planted extremely close together, allowing for plantation-style cultivation that could generate a tenfold increase in yield per acre. Too, because the small-diameter saplings require less dramatic freeze/thaw cycles to produce, the sapling technique could mitigate crop decline owing to climate change.

Photo Credit : Corey Hendrickson

Photo Credit : Corey Hendrickson

Photo Credit : Corey Hendrickson

—

Vermont sugarmakers need to hope that Vogelmann is right, because the truth is, there’s soon to be a lot more syrup on the global market even without the plantation method. Throughout my reporting, I kept hearing about a start-up sugaring operation in Vermont’s Northeast Kingdom that, according to rumor, would comprise 500,000 taps. Everyone I spoke with seemed to have heard of it, but no one was entirely certain of the details, with the exception of that number: 500,000. Half a million. Nearly 900 percent more taps than Tommy and Cecile Branon had. “All that syrup,” Cecile said to me, when the rumored sugarbush came up in conversation. “Where’s it gonna go?” The rumor turned out to be true. I learned that from Eric Sorkin, owner of Thunder Basin Maple Works in Cambridge, Vermont. In addition to running a maple-syrup operation, Sorkin also installs pipeline for other sugarmakers, including Wood Creek Capital Management, a New Haven, Connecticut, investment firm that specializes in so-called “real assets,” including those of an agricultural bent. The initial phase of the installation called for 50,000 taps, though when I visited the 44-year-old Sorkin in early July, the project was about a month behind schedule. “It’s getting tighter every day,” he told me. Still, whether the taps got in this year or next, the project would go forward, and the count would almost certainly rise toward the 500,000-tap potential, creating a sugarmaking entity that will dwarf the current kings of Vermont’s sugaring hill. It’s difficult not to draw parallels between the Wood Creek operation—which will rely primarily on local labor—and the state’s dairy industry, which has evolved inexorably toward larger and larger operations, in the process creating efficiencies of scale that have made it increasingly difficult for smaller farms to remain competitive.

Photo Credit : Corey Hendrickson

—

But the hazards aren’t limited to local weather events. That’s because the majority of the global supply of maple syrup—approximately 77 percent—is produced in Quebec under the auspices of a “syrup cartel.” Much like other cartels (oil being the most obvious example), the Quebec syrup cartel manipulates the demand/supply ratio, first by imposing quotas on Quebecois producers and second by maintaining a strategic syrup reserve that can be tapped in the event of a shortage. The reserve’s capacity is nearly 2.5 million gallons, split among three warehouses in rural Quebec towns; in 2012, thieves reportedly stole 6 million pounds (approximately 550,000 gallons) of syrup from a warehouse northeast of Montreal, refilling many of the emptied barrels with water to escape detection. Ultimately, 23 people were arrested, though about one-third of the stolen syrup was never recovered. As the Saudi Arabia of maple syrup, Quebec plays a major role in establishing wholesale price, which over the past six years has ranged widely, from about $2.25 to more than $4.25 per pound (a gallon of syrup weighs 11 pounds). American sugarmakers have a love/hate relationship with the syrup cartel: They hate the power the Canadians wield, and they have an entrepreneurial disdain for the quota system, which they suspect leads to lazy sugarmaking; conversely, they realize that in a bad season the maple reserve might be all that stands between themselves and a collapsed global market. The Canadian stranglehold on the maple industry does something else, too: It exposes American sugarmakers to the whims of international currency exchanges. “When we could sell 80 percent of Vermont production in Vermont, it wasn’t a problem,” David Marvin told me. “But now I have to watch that dollar every day. If the Canadian dollar goes to $1.50 again, a lot of people are going to be out of business.” That’s because syrup is priced in Canadian currency; therefore, if the Canadian dollar were to strengthen against the American dollar by one-third, American producers would receive 33 percent less for their syrup. But despite all this, the maple gold rush shows little sign of abating anytime soon. That’s in large part because maple syrup remains a bit player in the sweeteners aisle, fomenting the optimism that someday it won’t be such a bit player. Currently, a mere 6 percent of Americans consume syrup annually, for a per-capita annual consumption rate of 2.6 ounces, an amount I can confirm hardly does justice to a stack of pancakes. By comparison, Americans eat 20.8 ounces of honey and 464 ounces of added sugar annually. But, although syrup consumption is a comparative dribble, it’s also on the rise: In 1975, Americans ate just 1.03 ounces each year. And many in the industry are encouraged by trends toward more-natural sweeteners. “There are a lot of trends that play into maple,” Matt Gordon told me. “Sure, it’s sugar, but it’s all-natural. It’s wild. It’s got a better story to tell than other sugars.” What’s more, foreign consumption, while still a small piece of the puzzle, is rising fast, with Japan and Germany showing a particular fondness for maple.—

Is it possible, then, that Vermont’s (and by extension, the rest of New England’s) maple industry can keep growing into the foreseeable future? Is it possible that Tommy and Cecile Branon and the Sorkins, each with their 60,000-plus-tap operations, will no longer be viewed as anomalies, but as just the way things are? Is it possible, even, that the traditional sugarbush—a place of towering trees, soft breezes, and the unique peace of the wild—will soon be supplanted by cultivated rows of severed saplings? “If plantation maple ultimately replaces wild-harvested maple syrup, it would be tremendously sad,” Sorkin said. “I have no philosophical or ethical position against it. In fact, I briefly considered positioning myself to take advantage of the new technique, but ultimately decided against it. It’s just not the same thing anymore, and, right or wrong, I’ve made the decision that I don’t want to do it.” I thought back to my ride with Cecile Branon and how over the span of just a couple of hours, we’d churned past multiple relics of the Branon family’s sugaring history. Deep in the woods, we came across an old sugarhouse, its roof collapsed under a fallen tree. Stacks of long-abandoned sap buckets lay under the rotting rafters. Later, we buzzed across a field where one of the family’s retired draft horses nuzzled at winter-dead grass. The horse seemed hungry, and Cecile radioed for someone to bring a bale of hay. I thought about those 500,000 taps, part of an investment firm’s “asset management” portfolio. I pictured rows and rows of young maple saplings sheared at chest height, tethered to one another by plastic tubing clamped over the wound where their maturing crown once grew. I’d heard these plantations compared to cultivated apple orchards, but from what I’d seen at the Proctor Maple Research Center, fields of corn seemed a better analogy. Could such a thing really come to pass? On the one hand, it seemed improbable, almost impossible to fathom. On the other hand, no one had predicted a half-million-tap sugarbush, either. I remembered how, on that morning with Cecile, just after we’d crossed the horse pasture, I’d looked behind us, to where I could see the steam rising from the vented sugarhouse roof. It drifted into the air and then disappeared, unwanted water turned into nothing at all.Ben Hewitt

The Hewitt family runs Lazy Mill Living Arts, a school for practical skills of land and hand. Ben's most recent book is The Nourishing Homestead, published by Chelsea Green.

More by Ben Hewitt